“Money is and always has been political. Our central concern should not be with [money’s] technology but with the political and legal framework with which it operates”. ~ Dr. Rebecca L. Spang

By Catherine Austin Fitts

Table of Contents

I. Introduction

II. Global Pension Fund Assets

IV. A Comment on US Pension Fund History

V. Recent Global and US Pension Fund Performance

VI. The Pension Fund Crisis Narrative

VII. My Financial History as an Alternative Narrative

IX. Other Issues

XI. What Can I Do?

XII. Appendix

I. INTRODUCTION

Our planetary governance and financial system currently operates significantly outside of the law. Whether the cost of war, organized crime, corruption, environmental damage, suppression of technology or secrecy, this lawlessness – and the lawlessness it encourages in the general population – represents a heavy and expensive drag on all aspects of our society, our economy and our landscape.

The underfunding of pension funds in the United States is a symptom of that drag. It is not a self-contained crisis.

We are told that we can fix the pension funds by saving more – such as by increasing the contributions from beneficiaries and/or taxpayers. As portrayed in our graphic for the cover of this 2017 Annual Wrap Up, this is the equivalent of trying to fill a milk bucket by milking more cows when the problem is that there is a hole in the bucket. Why put more milk in the bucket until the hole is fixed or the farmer gets a new bucket?

If my subscribers and clients are representative, many people in the US general population – either as beneficiaries or taxpayer – are reluctant to invest more money in the retirement system. Many do not trust it.

- They do not trust pension fund governance and management to treat beneficiaries’ interests as primary.

- They do not trust money managers to invest wisely. They believe Wall Street promotes fraudulent securities.

- They do not trust central banks, the federal government and some state and local governments to behave responsibly.

- They are concerned that laws and regulations will be changed in an unfavorable manner – that their pension will become the financial equivalent of a “roach motel.” The money goes in, but it does not come out.

- They feel cheated by public agencies that engage in political patronage, for example, that enable workers to game their final working year or two (through overtime, extra shifts, undeserved last-minute promotions, and other manipulative gimmicks) to retire with pension payments that are as much as double what they are rightfully entitled to in the absence of such gimmicks.

Under these circumstances, the decision to avoid increased investment in pension plans or retirement vehicles may, in fact, be a wise decision, albeit it makes the underfunding “crisis” worse.

Addressing pension fund underfunding in the United States will require ensuring integrity in pension fund governance and investment policies where it has been eroded. It likely will also require the successful return to a model of household and family wealth accumulation where individuals and families control the governance and management of their assets instead of depending on centrally controlled systems. Family wealth has the distinct advantage of returning control of investment decisions to individuals. However, this is hardly what the US establishment wants. The centralization of power depends on the increasing control and concentration of family financial capital.

Whichever path we take, the success of our pension fund and retirement assets and their impact on financial markets and society will necessitate addressing the integrity of governmental and corporate governance in the global financial system.

This is the same point that we repeatedly make on the Solari Report. Our economy is a dynamic ecosystem. We cannot isolate one part and “fix it.” If there is a fundamental and systemic imbalance, such as corruption or lawlessness, it must be dealt with on a crosscutting basis.

If our political process delivers profits and a cheap cost of capital for insiders, while considering the general population expendable, the solution is not for everyone else to save more in the face of overwhelming fiscal, monetary and financial debasement due to demands by the first group. Indeed, the centralizers have become the financial equivalent of nymphomaniacs – kicking the capital centralization into liquidation of human and environmental capital to provide more cheap capital to the insiders. The solution is to address the fundamental corruption of the political mechanism. Over the long run the privileges afforded the few are shrinking the total pie.

I chose pension funds as the theme for the 2017 Annual Wrap Up to invest time in reviewing the current state of global and US pension plans. For a complete list of the most useful studies, book and articles I read as well as website sources I used, see our Bibliography section.

My goal in writing about the state of our pension system is to help you better understand and, where appropriate, reject parts of the official narrative – not get frozen in fear or overwhelmed by the complexity of it. My hope is that you gain a simple overview of the situation that can help you successfully navigate the specific aspects that touch you and your family, either as beneficiary or taxpayer. Without question, the underfunding of pension funds will impact you, one way or another.

If you are a US citizen, you are going to have to deal with the failure, by our various corporate, public and governmental agencies, to fully fund pension funds and health care promises.

These failures will touch you as a taxpayer. If you live in a state where the state and local pension funds are significantly underfunded, the impact on your state and local taxes, your property taxes (not to mention the appraised and market value of your home, farm, land or other real estate) and your municipal systems and services could be significant. Pension and health care liabilities may impact or determine in which state or locality you choose to live. Certainly, if you are planning on moving or buying real estate researching unfunded liabilities should be on your due diligence list. These failures will also impact you as a federal taxpayer for military and government employee obligations as well as for obligations assumed by the Pension Benefit Guaranty Corporation, as companies fail or shed their pension funds in bankruptcy.

If you depend on income from one or more pension funds that reduce benefits as a result of underfunding or that fail and are assumed by the Pension Benefit Guaranty Corporation, it could impact your quality of life, life expectancy and health.

This also extends to families and friends. If your parents’ pension benefits are canceled or cut, and they show up at your door wanting to live with you, you are likely not going to tell them, “Sorry, it’s not my problem.”

In addition, numerous things are happening in the world, including war, environmental degradation, significant credit problems in the fixed income markets or loss of reserve currency status for the dollar that could significantly decrease pension fund returns and asset values, thus diminishing existing funding ratios. This is one of many reasons the health of the entire economy and financial system are important to all of us.

The state of our current pension fund systems is one of the reasons I focus on the financial coup d’etat, including trillions of dollars of bailouts and money missing from the US government. You can’t be short trillions to fund contractual and legally obligated pension promises and simply allow $50+ trillion (my estimate) walk out the monetary and fiscal doors when you have no legal obligation and/or basis for doing so.

So let’s review the current state of US and global pension funds and see if we can’t change the narrative.

There is no pension fund crisis! The so-called pension crisis is the result of a leadership decision that financial obligations to the elderly are expendable. After buying their votes and labor with promises, the leadership is wiggling out of those promises by draining returns with an engineered housing bubble, low interest rates and not funding on a pay-as-you-go basis, then cutting benefits and throwing retirees overboard. Rather than pay for nursing homes, we prefer to expand the billionaire class and use our pension funds savings to provide low-cost capital to the national security state, automate with robotics and artificial intelligence, and invest in space and the transition to a multi-planetary civilization. One particularly good example of this is General Electric. By some estimates, its pension fund is underfunded to the tune of $31 billion. However, during the time its pension fund became so underfunded, GE spent $45 billion to buy back its publicly traded common stock. The needed funds were there at one point; it’s just that the leadership of the company decided to funnel it into stockholders’ hands rather than to the pensions of the employees who helped build the company.

This is a political choice. It is not a financial crisis. It is part of a well-executed plan.

It is a plan that has been engineered by two decades of deliberate central bank and government policies and related enforcement designed to centralize and reorganize the economy accordingly. It is a conscious and intentional abrogation of legal obligations, just as the housing bubble represented a fraudulent inducement.

The financial crisis is what happens to the beneficiaries and their families and the federal, state and local taxpayers who face higher taxes and reduced services.

II. GLOBAL PENSION FUND ASSETS

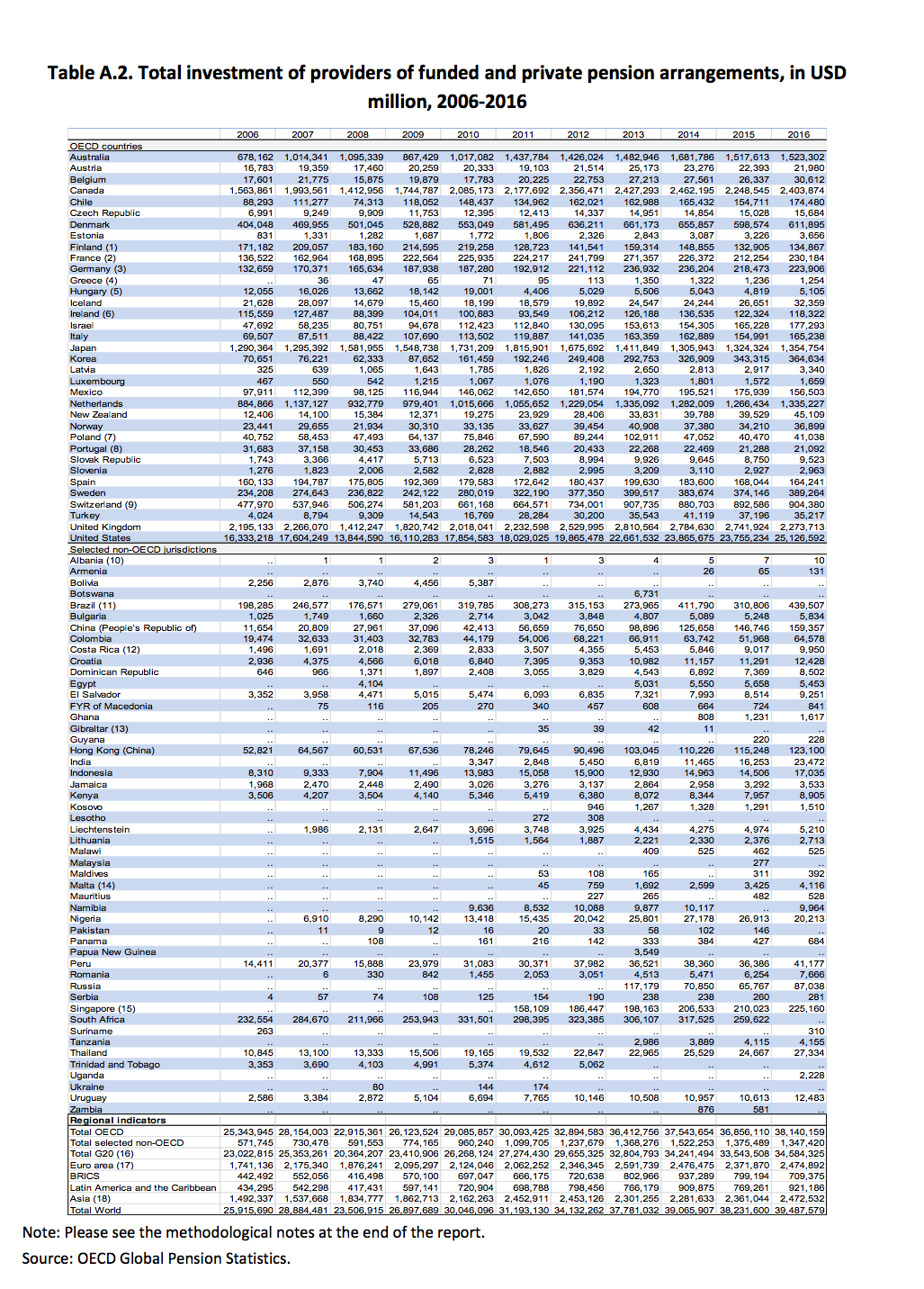

One of the best sources of current global pension fund statistics is the Organization of Economic Co-operation and Development (OECD) based in Paris. OECD has 35 members, primarily developed countries and a few emerging market countries. In 2017, the OECD published Pension Markets in Focus, 2017 Edition that is an overview of the status of global pension funds. It is important to remember when reviewing OECD tables and charts that they are drawing from non-conforming national data sources.

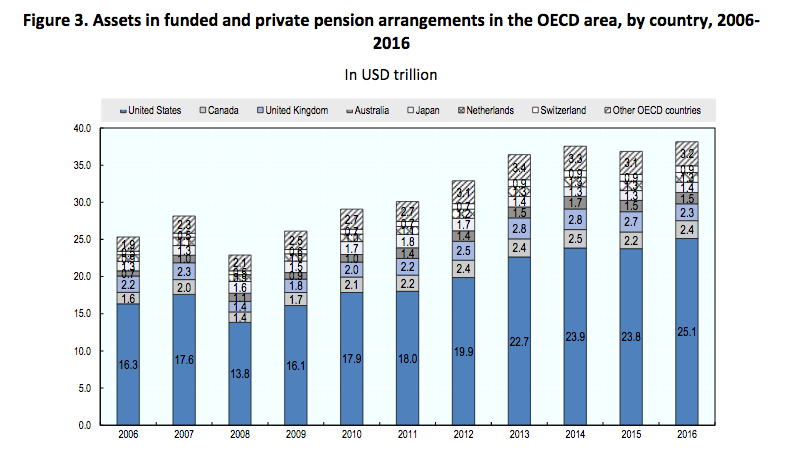

As of 2016, global pension fund assets totaled $40 trillion, of which $38 trillion was in OECD countries. Of that amount, $25 trillion was in the United States. So US pension assets are approximately 62.5% of global pension fund assets for people who are approximately 4.3% of the world population.

From the point of view of China, US pensioners are in very good shape. China has 18.3% of the world’s population and despite an aging population it has less than 1% of the world’s pension assets. Is there any wonder the Chinese are trying to create a global currency and is considering plans to reduce Treasury holdings?

Source: OECD Global Pension Statistics

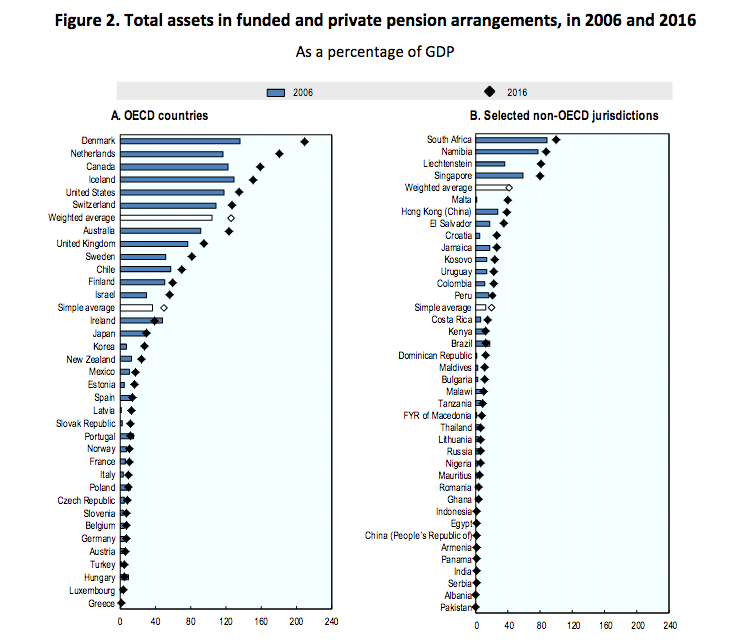

As of 2016, Denmark, the Netherlands, Canada and Iceland all had higher assets as a % of GDP than the United States and, with Switzerland, represent the countries above the weighted average for assets as a % of GDP within the OECD countries. If you want to read the story of the Netherland’s impressive reforms to maintain a sound pension system, read the section on the Netherlands in The Third Rail: Confronting Our Pension Failures by

Source: OECD Global Pension Statistics

III. US PENSION FUND ASSETS

Related Links

- Individual Retirement Accounts (IRAs)

- Defined Benefit Plans

- Defined Contribution plans

- 401(k)

- 403(b)

- 457

- Federal Employees Retirement Systems Thrift Savings Plan

- Pension Benefit Guaranty Corporation

The OECD figures for the United States include private pension funds, individual retirement accounts, state and local government employee retirement funds, federal government retirement funds and annuity reserves at life insurance companies. Again, data sources in the United States for these different areas are non-conforming. With that caveat, let’s look at a variety of estimated breakdowns.

As of the end of 2016, Pension & Investments reported on data compiled by the Investment Company Institute that U.S retirement assets totaled $25.3 trillion. IRAs were the largest component with an estimated $7.85 trillion in assets. Defined contribution plans were $7.03 trillion; government defined benefit plans were $5.46 trillion, private sector defined benefit plans were $2.9 trillion and annuity reserves were $2 trillion. Within the Defined Contributions (“DC”), 401(k) plans accounted for $4.8 trillion of the $7.03 trillion in assets. Other private sector DC plans had $550 billion in assets, $905 billion was in 403(b) plans, $282 billion was held by 457 plans and $467 billion in assets were in the Federal Employees Retirement System’s Thrift Savings Plan.

The Milliman survey of the top 100 corporate pension funds reports: “These pension plans finished 2016 with pension assets of $1.395 trillion and projected benefit obligations (“PBO”) of $1.718 trillion. The funded ratio at the end of 2016 was 81.2%.”

According to Public Plans Data, the combined value of defined benefit plan assets held by state and local governments as of Q4 2016 was $3.85 trillion based on the Federal Reserve Flow of Funds report, September 2017. Public Plan Data states that there are 299 state-administered plans and 5,977 locally administered plans, however, their database is comprised of 170 state and local plans which represent ~95% of the market. In 2016 these pension funds had $3.31 trillion in assets against $4.58 trillion of liabilities. They were 72 % funded, which had steadily declined from 102 % funding in 2001. It appears that assets have grown 52.2% from 2001 to 2016, but during this time liabilities have grown 115.5%.

According to a 2016 report addressing federal plans from Moody’s:

The unfunded liabilities of the various federal employee pensions systems, covering civilian and military employee benefits, amount to about $3.5 trillion, or 20% of US GDP. Additionally, Moody’s estimates that unfunded state and local government pension plan liabilities are of the same magnitude, bringing the total shortfall to 40% of GDP….The bigger challenge to the US comes from the unfunded liabilities for the Social Security and Medicare programs. The Social Security funding gap is estimated at $13.4 trillion, or 75% of GDP, while the shortfall from the Hospital Insurance component of the Medicare program amounts $3.2 trillion, or 18% of GDP.

Tom McKinney, posting at Bill Bergman’s blog at Truth in Accounting, posted the assets for the US Civil Service Retirement and Disability Fund as of 2015:

The U.S. Civil Service Retirement and Disability Fund (retirement fund) has just 48 percent of assets needed to cover future pensions for retired and active federal employees. Currently, there are 2.6 million retired and 2.7 million active federal civilians enrolled, including US Postal Service personnel. As of September 30, 2015, the retirement fund pension assets were $880 billion and the retirement fund pension liabilities were over $1.8 trillion. The $880 billion of pension assets is often referred to as a “pension trust fund.” Agency employers and agency employees underfunded the retirement fund every year, for decades. This resulted in an unfunded pension liability of nearly $1 trillion. Therefore, the US Treasury Department’s General Revenues rescued the retirement fund every year, for at least 30 years. The rescue money is often referred to as a: subsidy, supplemental payment, transfer-in, or a bailout.

Official Monetary and Financial Institutions Forum (OMFIF) is a public think tank based in London and Singapore that tracks global investment by public investors, specifically the largest 750 public pension funds, central banks and sovereign wealth funds. Their report for US federal pension fund assets at the end of 2016 showed $600.6 billion for the US Military Retirement Fund, $557.9 billion for the Federal Employees Retirement Systems, $480.4 for the Thrift Saving Plan and $322.9 for Civil Service Retirement.

The Pension Benefit Guaranty Corporation (PBGC) is a US government agency created by the Employee Retirement Income Security Act of 1974 (ERISA). The PBGC provides a backstop for the retirement incomes of 40 million American workers in nearly 24,000 private sector defined benefit pension plans. The PBGC, just like the FDIC in the banking sector, is funded by insurance premiums paid by employers that sponsor insured pension plans, and PBGC also receives funds from the various defunct pension plans it takes over. In the same way that the FDIC steps in to provide some relief to financial institution customers when their bank, savings and loan or thrift fails, the PBGC steps in to help those retirees counting on a pension income after their employer defaults and disappears due to insolvency. However, although they are somewhat protected by PBGC, pensioners often receive 50 cents or less on the dollar relative to what they would have received if their previous employer didn’t go insolvent. In 2016, PBGC paid for monthly retirement benefits for nearly 840,000 retirees in more than 4,700 single-employer and multiemployer pension plans that cannot pay promised benefits. Including those who have not yet retired and participants in multiemployer plans receiving financial assistance, PBGC is currently responsible for the pensions of approximately 1.5 million people.

From all available data, it appears that the underfunded ratio is rising on defined benefit plans in the United States in recent years despite an unprecedented rise of the US equity market over the same period. Due to rising underfunded ratios and the dumping of pension plans by companies who can’t meet their long-standing pension obligations using the protection of reorganization and bankruptcy laws, there are serious questions as to the PBGC’s ability to meet current and anticipated future pension obligations, whether or not taxpayers are called upon to provide even further funding toward them.

Putting the size of total US pension fund assets into context, it helps to compare them to the market capitalization of the stock and bond markets. As of the end of 2014, the US stock market was approximately $26 trillion and the US bond market was approximately $40 trillion. Recent estimates of the global stock market capitalization are approaching $80 trillion with the US stock market approaching $30 trillion. As sovereign debt has ballooned since 2008, it has become increasingly difficult to find reliable estimates of total bond market capitalization, but a reasonable guestimate is that it has grown from $100 trillion cited by Bloomberg in 2016.

When you compare total US-funded pension fund assets of $25 trillion to both global and US stock and bond market capitalization, it is clear that US pension funds are a significant financial market participant.

IV. A COMMENT ON US PENSION FUND HISTORY

I want to make a few comments about the history of US pension funds because I have a different viewpoint from that of the official narrative.

After World War II, the United States lead the implementation of the Bretton Woods System, building and enforcing a global open trade model. To take advantage of this model, it was important to the US leadership to create a stable labor force and maintain stable labor relations. Pension funds were one of the benefits used to create those stable relations.

Pension funds also helped to centralize capital to finance the growth of the large multinational corporations designed to compete successfully in the Bretton Woods system. Instead of workers taking home their full pay and saving privately, corporations created a vehicle whereby employees put a certain portion of their pay into a centrally controlled pool. This served as a form of capital aggregation and control.

I often refer to the Department of Justice as being in charge of the “control, centralization and concentration of cash flow.” I call the Patriot Act the ‘Control and Concentration of Cash Flow Act’. Promoting centralized pension vehicles has been part of this effort to control capital. Pension funds helped to shift the United States from a country in which most savings were controlled by households to a model characterized by centralized savings into pools that could be managed and directed centrally. This also meant capital could be controlled and invested – even drained – in ways that were remarkably invisible.

If you want to build a global juggernaut of both multi-nationals and the national security state, you need an enormous flow of capital. Pension funds were an essential vehicle to control and concentrate cash flow to do so.

As the corporate system grew, globalization kicked in. Suddenly you could change your relationship with labor because you could access a labor market globally and play those workers off against each other. The Neoliberal economic and trade experiments in Argentina and Chile pioneered by Professor Milton Friedman and his brethren of the Chicago School of Economics, which had devastating and long-lasting consequences for those countries, are further evidence of Mr. Global’s tampering with properly functioning labor markets. This process was turbocharged after the adaption of the Uruguay Round of GATT and the creation of the World Trade Organization in 1995. If you haven’t watched the Sir James Goldsmith video on globalization, it is a marvelous introduction and explanation of that system and how devastating it has been to labor in Europe, the United States and the developed world.

Sir James Goldsmith’s 1994 Globalization Warning

Even though globalization renegotiated the corporate relationship with labor, the leadership still wanted and needed to maintain centrally controlled capital. The question was: How do you keep the central control and get out of providing the rich benefits? Of course, switching to defined contribution plans was one of the ways that happened. Dumping pension funds on the PBGC after the agency was created in 1974 was another.

The most significant challenge, however, was what would happen when the baby boomers started to retire. Society has aggregated and concentrated this large capital pool to provide stable, cheap financing to build this multinational juggernaut and the national security state. The problem with the boomers’ retirement is, not only will they stop adding capital but, also, they are going to want their money back to pay for retirement. This is a “$2 problem.” Boomers are not going to put in a new dollar – that’s a $1 problem. And, they will want to take a dollar out which results in a $2 problem.

If you listen to my many presentations on the financial coup d’état, I think that the G-7 leadership saw the boomer retirements coming and said, “We have to pull capital out of these systems before the boomer retirement comes due. Then when the boomer retirements come due, we’ll stuff their pension funds full of obligations, such as mortgage-backed securities on their homes or treasury securities on their economy. We’ll bubble the economy and stick the paper in their pension funds. They can come up with a fiscally responsible solution. They can stew in their own juices.”

If you look at the history of pension funds, I don’t see it as something that the country wanted to do for the working population; I think that it was something they used to attract the working population into a certain kind of job and relationship, but the real goal was to concentrate cash flow and control to ensure that the national security state and its corporations had the lowest cost of capital in the global markets. The last thing they wanted to do was return that capital and cash flow.

When the boomers retire, the question was how to overcome the “$2 problem.” I think the answer was the financial coup d’etat – shift enough capital out of existing institutions so that the boomer retirements could not pinch the financing of the national security state and the multinational banks and corporations that operate it.

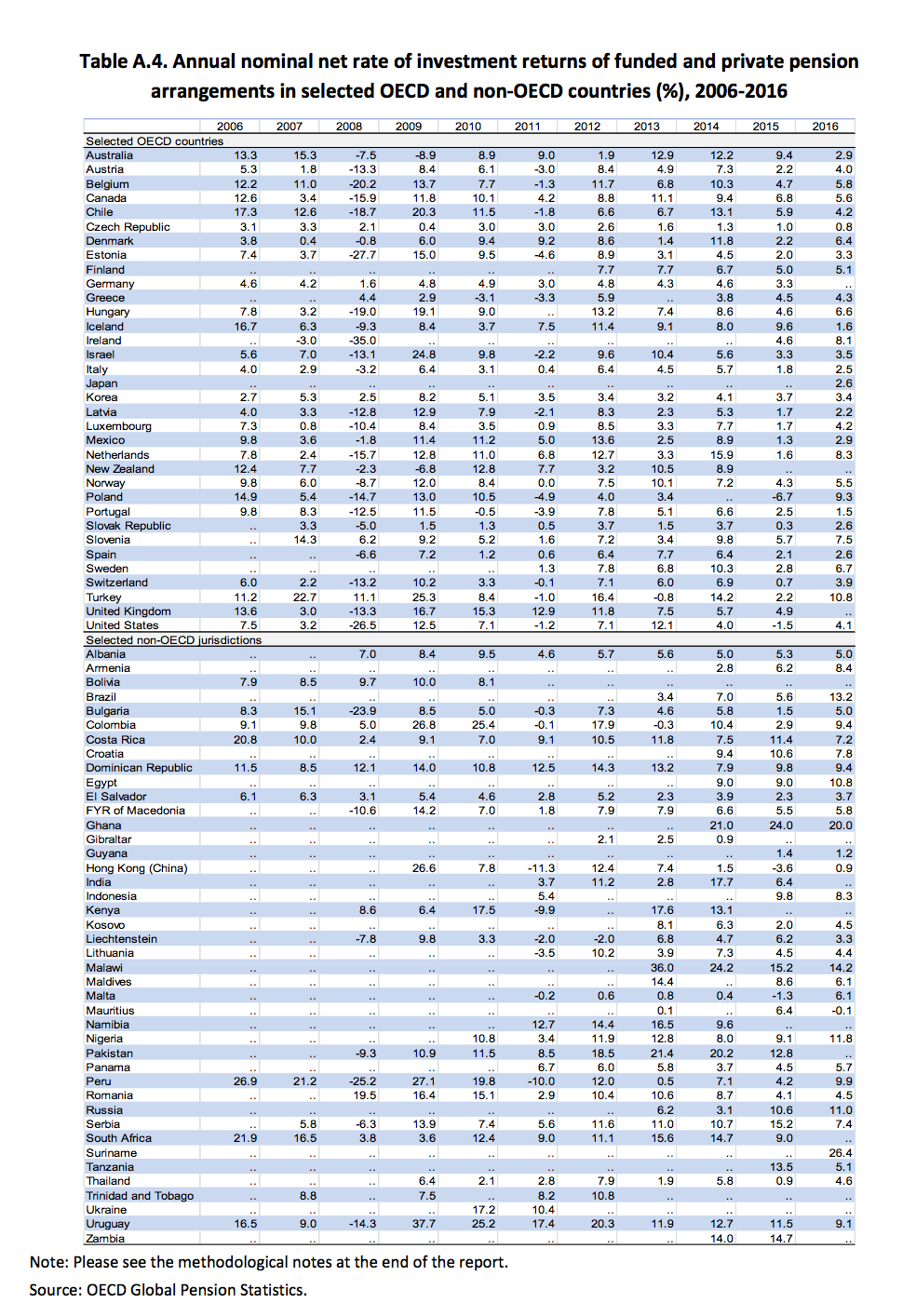

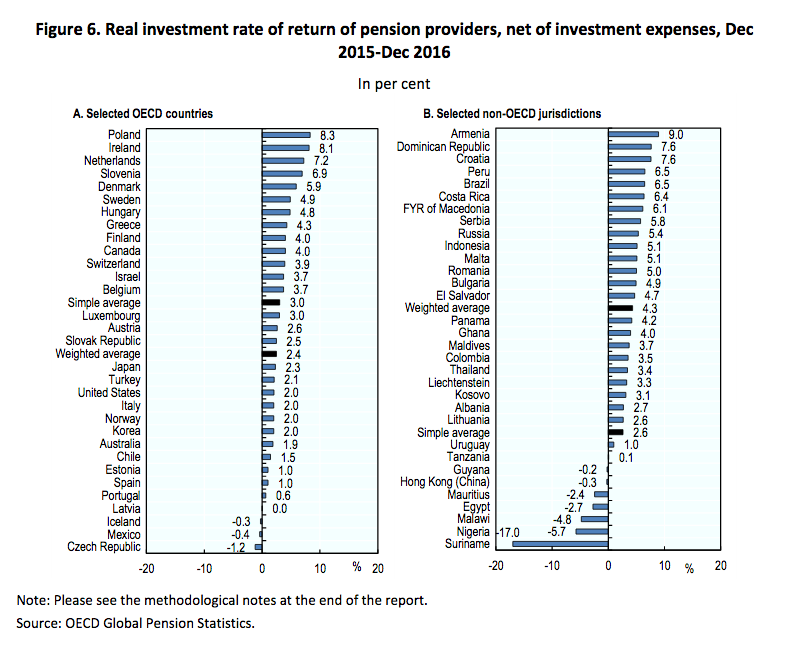

V. RECENT GLOBAL AND US PENSION FUND PERFORMANCE

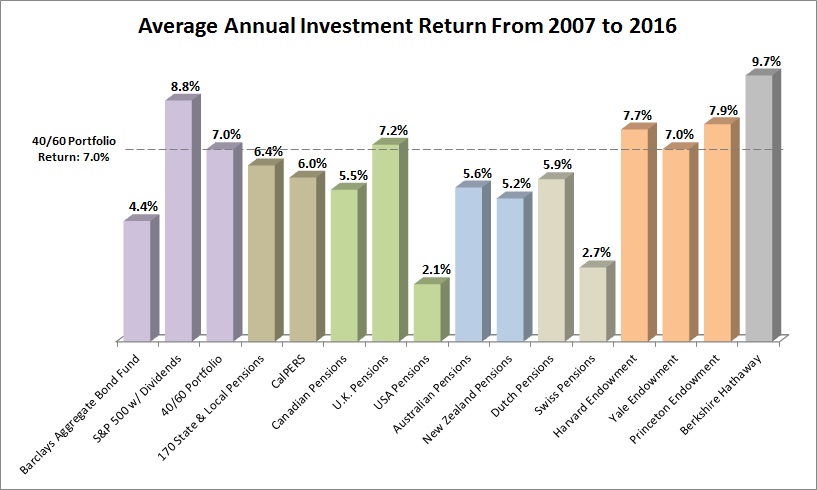

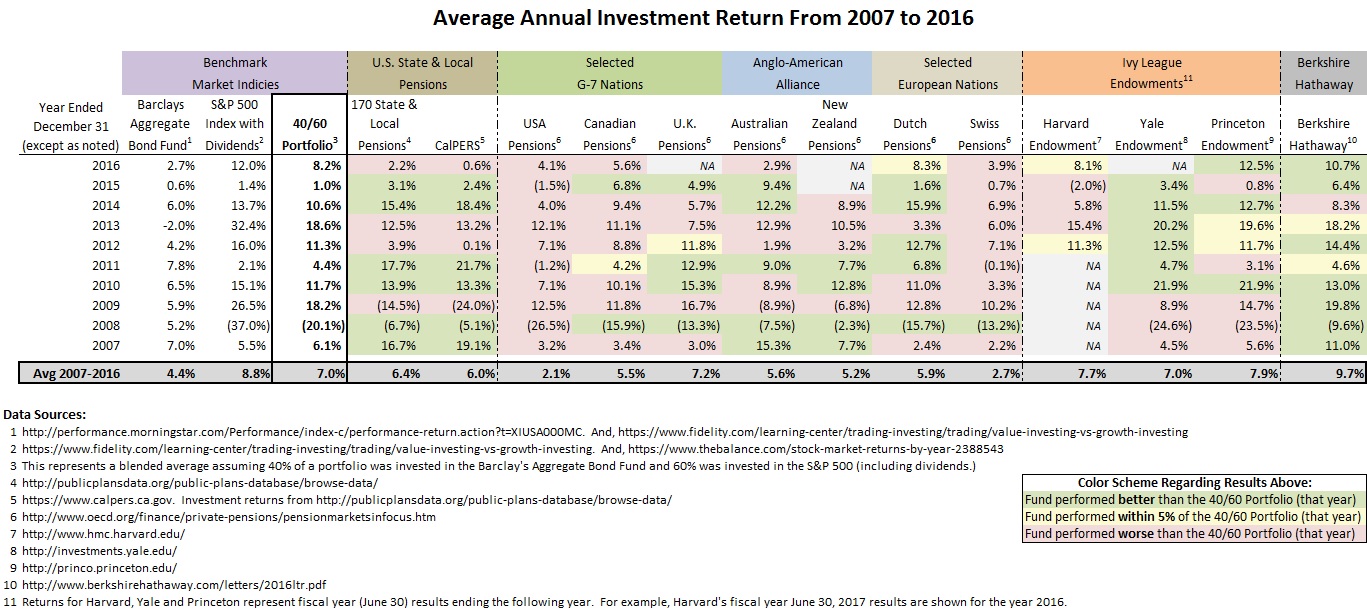

The chart and table below show the investment returns of various market indices, pension funds and educational endowments over the 10-year period beginning in 2007 and ending in 2016. The top chart shows the overall average during this 10-year period. The table provides the detailed data for all years with footnotes explaining the sources.

Going left to right in the chart, the first three purple bars show a benchmark for comparison to fund returns. The first is the “Barclays Aggregate Bond Fund” which represents bonds that have been historically considered a stable investment but have lower returns. This has been the case as interest rates dropped steadily between 1980-2016. The second is the “S&P 500 Index with Dividends,” which represents the returns for a common index of the US stock market. As most pension funds have a blended allocation consisting of both stocks and bonds, the third is a “40/60 Portfolio,” and it represents a blended approach. It assumes a hypothetical investment profile where 40% is invested in the Barclays Aggregate Bond Fund and 60% is invested in the S&P 500 Index with Dividends. This ignores the likelihood that pension funds can be expected to have a portion of their assets in cash, global stocks, land and real estate and alternative investments.

We found some excellent data on public pension funds from PublicPlansData.org, a collaborative effort by the Center for State and Local Government Excellence, the National Association of State Retirement Administrators, and the Center for Retirement Research at Boston College. This site currently tracks 170 plans across the United States, of which 114 are administered at the state level and 56 are administered locally. The funds they track represent 95 percent of public pension membership and assets nationwide. Chances are, if you are teacher, police officer, firefighter or otherwise work for a state or local municipality, you’re probably covered by one of these plans.

During the period 2007 to 2016, these 170 public pension plans made an average return of 6.4% per annum, compared to the 40/60 Portfolio, which averaged 7.0% during this time. These funds, on average, outperformed the 40/60 Portfolio in six of those years and underperformed in four.

Looking solely at the average return of 6.4% and the funds’ collective ability to beat the 40/60 benchmark in six out of 10 years, one could draw the conclusion these funds are not doing too bad. But the real health of these funds can only be fully assessed by looking at other numbers not shown on this chart, such as the amount of liabilities which are currently funded by these assets and the number of active workers who are currently supporting retirees drawing pension payments. Both of these metrics are discussed elsewhere in this wrap-up, and they’ve only been getting worse over the past 10 years.

CalPERS, the California Public Employees’ Retirement System, is one of the 170 public pension plans included in the prior aggregate. With over $302 billion in plan assets, it is also the largest of these plans and one that is very well known and rather powerful as one of the largest stock market investors. For this reason, we thought it worthwhile to show CalPERS separately.

CalPERS’ overall return in this 10-year period was 6.0%. This was below both the average of the collection of 170 state and local pension funds and also the 40/60 Portfolio. What is interesting is that CalPERS over-performed and under-performed the 40/60 Portfolio in all the same six and four years, respectively, as the collection of 170 state and local pension funds. But, given that CalPERS’ assets represent approximately one-tenth of that overall collection, the correlation is not too surprising.

Using data from OECD, the next three green bars show Canada, the United Kingdom and the United States. Canada’s average annual pension returns for 2007-2016 were 5.5% while the United Kingdom pensions returned 7.2%. However the US pensions returned 2.1%. Based on the OECD definition, this would include the 170 state and local pension funds in the Public Plans Data. With $3.8 trillion in assets, they should make up approximately 15% of the $25 trillion of the US pensions. If you look at individual annual returns during the 10-year period, US pension funds dropped by more than double compared to their OECD peers during the 2008-2009 time frame. The implications are sobering for what this average implies about IRA and defined contribution returns over a period despite a US equity market performance that was much better than expected. One likely explanation for a portion of this underperformance is the fact that American individuals fear losses from the stock market (particularly as a result of the dramatic losses and corruption of the financial crisis) and therefore hold an unreasonably large portion of their IRA assets in cash, which provides effectively zero return, or fixed income significantly bringing down the overall average. Either way, there may be unfortunate–but understandable–explanations why America’s retirement asset rates of return significantly lag those of other more socialist counties where the retirement funds are effectively state-administered.

Next in blue and tan are other OECD members: Australia, New Zealand, Netherlands and Switzerland with ten year average annual returns of 5.6%, 5.2%, 5.9%, and 2.7%. These are all beneath the benchmark, with the exception of Switzerland, but significantly ahead of the United States. Finally we have added returns in orange for three Ivy League University endowments: Harvard, Yale and Princeton at 7.7%. 7.0% and 7.9%. and in grey for Berkshire Hathaway, Warren Buffet’s conglomerate, at 9.7%.

Related Links

- CalPERS

- Harvard University endowment

- Yale University endowment

- Princeton University

- Berkshire Hathaway

- Pensions in Canada

- Pensions in the UK

- Superannuation in Australia

- New Zealand Superannuation Fund

- Pension system in Switzerland

- Pensions in the Netherlands

Although the size and legal flexibility of the endowments and Berkshire Hathaway make it possible for them to be more nimble in alternative investments such as venture capital, real estate and commodities, their consistent out performance reminds me of my trading floor partner at Dillon, Read & Co. Inc. Whenever he found a trader outperforming the market, he would rise from his desk and come out screaming across the trading floor, “Explain to me exactly why I am so lucky!” My personal experience with the Harvard Corporation at the time of its spectacular endowment returns during the Clinton administration underscored how some of those returns came at great expense to the US taxpayer, including on the HUD budget, losses on the housing bubble, the Enron debacle and the “Rape of Russia.” The Harvard Corporation and Endowment’s brilliance at sticking back door bills to the taxpayer inspired me to write an editorial proposing that they lose their tax exemption. It was not surprising to see a small tax placed on endowment returns over $500,000 per student in the latest tax reform legislation.

The following charts from the 2017 OECD study show a wider comparison of annual nominal returns and real returns (after adjustment for inflation) with both OECD and non-OECD member countries. The reported under performance of the US plans below the weighted average is hard to explain given the performance of the US equity markets although the significant drop during 2008 is a major contributor in US underperformance. It would not surprise me if other contributors were IRA’s and defined contribution plans staying out of the equity market after the losses of the financial crisis and bailouts. The challenge for investors was not just the dramatic losses – it was a practical concern with the unaddressed corruption in the financial system.

VI. THE PENSION FUND CRISIS NARRATIVE

Related Link

The official narrative is that we are facing a serious pension fund crisis. This view is shared by David Collum, a Chemistry Professor who publishes an excellent annual overview. In his 2017 Year in Review, Collum provides a good description of the underfunding challenge. Here is his pension fund section republished with his permission:

“This massive financial bubble is a ticking time bomb, and when it finally goes off, it is going to wipe out virtually every pension fund in the United States.” ~Michael Snyder, DollarCollapse.com blog

The impending pension crisis is global and monumental with no obvious way out. The World Economic Forum estimates the pension gap—unfunded pension liabilities—at $70 trillion and headed for $250 trillion by 2050.166Conservative but still conventional assumptions about prospective investment returns and spending patterns in old age suggest that retiring into the American dream in your mid 60s requires you bank 20–25 multiples of your annual salary (or a defined benefit plan that is the functional equivalent) to avoid the risk of running out of money. A friend—a corporate executive no less—retired with 10 multiples; he could be broke within a decade (much sooner if markets regress to historical means). Of course, you can defiantly declare you will work ’till you drop, but then there are those unexpected aneurysms, bypass surgeries, layoffs, and ailing spouses needing care. I’ve seen claims that more than 50 percent of retirees do not fully control their retirement age.

“Companies are doing everything they can to get rid of pension plans, and they will succeed.” ~Ben Stein, political commentator

The problem began as worker compensation became reliant on future promises—IOUs planted in pension plans—often assuming the future was far, far away. However, a small cadre of demographers in the ’70s smelled the risk of the boomer retirements and began swapping defined-benefit plans for defined-contribution plans.167 (A hybrid of the two traces back to 18th century Scottish clergy.168) The process was enabled by the corporate-friendly Tax Reform Act of ’86.169 Employees were unknowingly handed all the risk and became their own human resource specialists.

Retirement risk depends on the source of your retirement funds. Federal employees are backstopped by the printing press, although defaults cannot be ruled out if you read the fine print.170 States and municipalities could get bailed out, but there are no guarantees. Defined-benefit corporate plans can be topped off by digging into cash flows provided that the cash flows and even the corporation exist. The depletion of corporate earnings to top off the deficits, however, will erode equity performance, which will wash back on all pension funds. The multitude of defined-contribution plans such as 401(k)s and IRAs managed by individuals are totally on their own and suffer from a profound lack of savings.

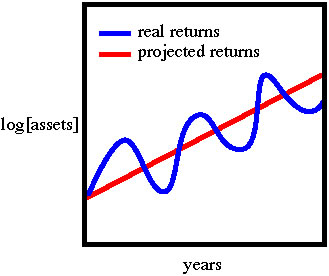

Corporate and municipal defined-benefit plans assumed added risks by falling behind in pension contributions motivated by efforts to balance the books and, in the corporate world, create the illusion of profits. The moment organizations began reducing the requisite payments by applying flawed assumptions about prospective returns, pensions shifted to Ponzi finance. My uncanny ability to oversimplify anything is illustrated by the imitation semi-log plot in Figure 25. The red line reflects the assumed average compounded balance sheet from both contributions and market gains. The blue squiggle reflects the vicissitudes of the market wobbling above and below the projection. If the projections are too optimistic—the commonly reported 7–8 percent market returns certainly are—the slope is too high, and the plan will fall short. If the projected returns are reasonable but management stops contributing during good times—embezzling the returns above the norm to boost profits—the plan will fall below projection again. Of course, once the plan falls behind, nobody wants to dump precious capital into making up the difference when you can simply goose projected returns with new and improved assumptions. In a rational world, pensions would be overfunded during booms and underfunded during busts. Assuming we can agree that we are deep into both equity and bond bull markets and possibly near their ends, pensions should be bloated with excess reserves (near a maximum on the blue curve), and bean counters should keep their dirty little paws off those assets and keep contributing because we won’t stay there.

Figure 25. Childish construct of pension assets.

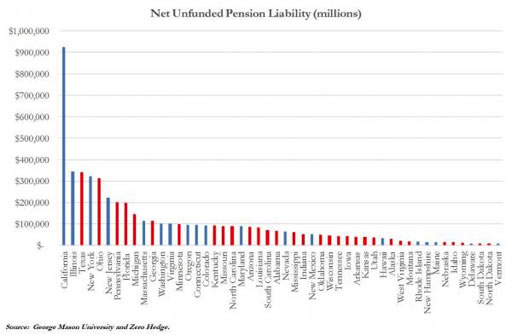

That’s a good segue to drill down into the contemporaneous details. Public pensions are more than 30 percent underfunded ($2 trillion).171 A buzzkiller at the Hoover Institution says that the government disclosures are wrong and puts the deficit at $3.8 trillion.172 Bloomberg says that “if honest math was being used . . . the real number would actually be closer to 6 trillion dollars.”173 What is honest math? Using prevailing treasury yields for starters. Bill Gross—the former Bond King—says that if we get only 4.0 percent total nominal return rather than the presumed 7.5 percent, pensions are $5 trillion underfunded.174 Assuming 100 million taxpayers, that’s $50,000 we all have to pony up. California’s CalPERS fund dropped its assumption to a 6.2 percent return—still seriously optimistic in my opinion—leaving a $170 billion shortfall.175 The Illinois retirement system is towing a liability of $208 billion with $78 billion in assets ($130 billion unfunded).176 Connecticut is heading for a “Greece-style debt crisis” with $6,500 in debt per capita (every man, woman, and child?).177 The capital, Hartford, is heading for bankruptcy.178 South Carolina’s government pension plan is $24 billion in the hole. Kentucky’s attempt to fill a gigantic hole in its pension fund (31 percent funded) was felled by politics.179 A detailed survey of municipal pension obligations shows funding ranging from 23 percent (Chicago) to 98 percent (Suffolk).180 My eyeball average says about 70 percent overall. Notice that despite being at the peak of an investment cycle, none are overfunded (Figure 26.) Large and quite unpopular 30 percent hikes in employee contributions are suggested. The alternative of taking on more municipal debt to top off pension funds is a common stopgap measure of little merit long term; somebody still has to pay.

Figure 26. State pension deficits.

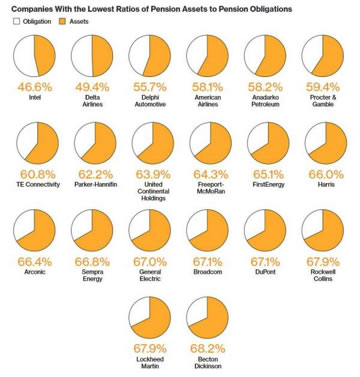

The 100 largest U.S. corporate defined-benefit plans have dropped to 85 percent funded from almost 110 percent in 2007. During the recent market cycle that burned bright on just fumes, the companies gained only 6 percent above the 80 percent funding at the end of 2008. Of the top 200 corporate pensions in the S&P, 186 are underfunded to the tune of $382 billion (Figure 27). General Electric, for example, is $31 billion in the hole while using $45 billion for share buybacks.

Figure 27. Underfunding of 20 S&P pension funds.

When are serious problems supposed to start, and what will they look like? Jim Bianco says “slowly and then suddenly.” Some would argue “now.” The Dallas Police and Firemen Pension Fund is experiencing a run on the bank.181 They are suing a real estate fund who slimed them out of more than $300 million182 and are said to be looking at $1 billion in “clawbacks” from those who got out early trying to avoid the pain.183 The Teamsters Central States and the United Mineworkers of America plans are failing.184 The New York Teamsters have spent their last penny of pension reserves.185 The Pension Benefit Guaranty Corporation has paid out nearly $6 billion in benefits to participants of failed pension plans (albeit at less than 50 cents on the dollar), increasing its deficit to $76 billion. CalPERS intends to cut payouts owing to low returns and inadequate contributions (during a boom, I remind you).

“The middle 40% [of 50- to 64-year olds] earn $97,000 and have saved $121,000, while the top 10% make $251,000 and have $450,000 socked away.”

~Wall Street Journal

Looks like those self-directed IRAs aren’t working out so well either. Two-thirds of Americans don’t contribute anything to retirement. Only 4 percent of those earning below $50,000 a year maxes out their 401(k)s at the current limits.186 They are so screwed, but I get it: they are struggling to pay their bills. However, only 32 percent of the $100,000+ crowd maxes out the contribution. When the top 10 percent of the younger boomers have two multiples of their annual salary stashed away, you’ve got a problem.186 If they retired today, how long would their money last? That’s not a trick question: two years according to my math. Half the boomers have no money set aside for retirement. A survey shows that a significant majority of boomers are finding their adult children to be a financial hardship.187 Indeed, the young punks aren’t doing well in all financial categories; retirement planning is no exception. Almost half of Gen Xers agreed with this statement: “I prefer not to think about or concern myself with retirement investing until I get closer to my retirement date.”

Moody’s actuarial math concluded that a modest draw down would cause pension fund liabilities to soar owing to a depletion of reserves.188 There is a bill going through Congress to allow public pensions to borrow from the treasury; they are bracing for something.189 This is a tacit bailout being structured. The Fed cowers at the thought of a recession with good reason: Can the system endure 50% equity and bond corrections—regressions to the historical mean valuation? What happens when monumental claims to wealth—$200 trillion in unfunded liabilities—far exceed our wealth? Laurence Kotlikoff warned us; we are about to find out.190 Beware of any thinly veiled claim that the redivision of an existing pie will create more pie.

My sense is that we are on the cusp of a phase change. Stresses are too large to ignore and are beginning to cause failures and welched promises. Runs on pension funds akin to runs on banks would be deadly: people would quit working to get their pensions. At this late stage in the cycle, you simply cannot make it up with higher returns. Enormous appreciation has been pulled forward; somebody is going to get hosed. It’s only fourth grade math. Bankruptcy laws exist to bring order to the division of limited assets. We got into this mess one flawed assumption at a time.

On a final note, there is a move afoot to massively reduce contributions to sheltered retirement accounts. This seems precisely wrong. (I have routinely sheltered 25–30 percent of my gross income as a point of reference.) Congress is also pondering new contributions be forced into Roth-like accounts rather than regular IRAs. I have put a bat to the Roth IRA both in print191 and in a half-hour talk.192 Here is the bumper sticker version:

- Roth IRAs pull revenue forward, leaving future generations to fend for themselves;

- Fourth grade math shows that Roth and regular IRAs, if compounded at the same rate and taxed at the same rate, provide the same cash for retirement.

- Roth IRAs are taxed at the highest tax bracket—the marginal rate—whereas regular IRAs are taxed integrated over all brackets—the effective tax rate.

If you read a comparison of Roth versus regular IRAs without reference to the “effective” versus “marginal” rate, the author is either ignorant or trying to scam you. Phrases like “it depends on your personal circumstances” are double-talk. This synopsis of a Harvard study has two fundamental errors: Can you find them?

“If a worker saves $5,000 a year in a 401(k) for 40 years and earns 5% return a year, the final balance will be more than $600,000. If the 401(k) is a Roth, the full balance is available for retirement spending. If the 401(k) is a traditional one, taxes are due on the balance. Let’s say the person’s tax rate is 20% in retirement. That makes for a difference of $120,000 in spending power, which a life annuity will translate into about $700 a month in extra spending.”

~John Beshears, lead author of a Harvard study

Footnotes:

166. http://www.zerohedge.com/news/2017-05-26/global-pension-underfunding-will- grow-400-trillion-over-next-30-years-world-economic

167. https://en.wikipedia.org/wiki/Defined_benefit_pension_plan

168. https://www.amazon.com/Sapiens-History-Humankind-Yuval- Harari/dp/0062316095/ref=sr_1_1?s=books&ie=UTF8&qid=1513355290&sr=1- 1&keywords=sapiens

169. https://twitter.com/MarkYusko/status/878459053760012288

170. http://www.mauldineconomics.com/frontlinethoughts/uncle-sams-unfunded- promises/

171. https://www.cnbc.com/2014/09/26/us-public-pension-gap-at-least-2-trillion- moodys.html

172. https://www.hoover.org/research/hidden-debt-hidden-deficits-2017-edition

173. http://theeconomiccollapseblog.com/archives/the-ticking-time-bomb-that-will-wipe- out-virtually-every-pension-fund-in-america

174. http://www.zerohedge.com/news/2017-08-31/pension-ponzi-exposed-minnesota- underfunding-triples-after-tweaking-one-small-assump

175. http://milleronthemoney.com/calexit-beat-crowd/

176. https://www.themaven.net/mishtalk/economics/illinois-general-assembly-retirement- system-only-13-52-sdnE62oHWUqI1DCysXX0HQ

177. http://www.zerohedge.com/news/2017-08-23/hartford-bankruptcy-looms-ct-gov- admits-we-spent-money-wrong-things

178. http://bit.ly/2yJHukJ

179. http://www.zerohedge.com/news/2017-10-18/kentucky-republicans-cave-pension- reform-stick-it-taxpayers-kick-can-approach-instea

180. http://www.zerohedge.com/news/2017-07-11/5-charts-explain-just-how-screwed- your-state

181. http://www.zerohedge.com/news/2017-08-08/record-number-dallas-police-officers- quit-july-amid-ongoing-pension-crisis

182. http://bit.ly/2AZjiRt

183. http://www.zerohedge.com/news/2017-01-06/city-dallas-looks-clawback-ill-gotten- pension-gains-dallas-police

184. http://dollarcollapse.com/pension-funds/pensions-thing-gets-real/

185. http://bit.ly/2lorr5q

186. http://www.businessinsider.com/americans-maxing-out-401k-retirement-savings- 2017-10

187. https://www.sunriseseniorliving.com/blog/september%202011/more-boomers- assisting-adult-children.aspx

188. http://www.zerohedge.com/news/2017-06-22/moodys-modest-downside-scenario- could-spark-59-surge-net-public-pension-liabilities-

VII. MY FINANCIAL HISTORY AS AN ALTERNATIVE NARRATIVE

I thought it would be helpful if I used a portion of my own financial history to explain why I think that the official narrative is not the appropriate way to look at what is happening to our pension funds.

The President of CalPERS Warning

My story starts with a meeting in the spring of 1997. It’s a story that I told in Control 101 and in Dillon, Read & Co. and the Aristocracy of Stock Profits about the President of CalPERS warning me about what I now refer to as the financial coup d’etat:

‘The response from the pension fund investors was quite positive until the President of the CalPers pension fund — the largest in the country — said, “You don’t understand. It’s too late. They have given up on the country. They are moving all the money out in the fall (of 1997). They are moving it to Asia.” He did not say who “they” were but did indicate that it was urgent that I see Nick Brady — as if our data that indicated that there was hope for the country might make a difference. I thought at the time that he meant that the pension funds and other institutional investors would be shifting a much higher portion of their investment portfolios to emerging markets. I was naive. He was referring to something much more significant.’

The fall that the president of CalPERS was referring to was the fall of October 1997, which was the beginning of federal fiscal 1998. This was when the $21 trillion started to go missing from HUD and DOD. For more on this missing money, see our presentation at the Missing Money website at https://missingmoney.solari.com

This meeting underscored for me that the governance system of the largest pension fund in the country was not what the law said the governance system was. If the banking establishment, including the US Treasury and Federal Reserve, could engineer a housing bubble that sucked massive amounts of capital out of the country, and in so doing dictate to CalPERS that the largest pension fund in the country continue to buy billions of mortgage-backed securities and Fannie Mae and Freddie Mae stocks, ultimately taking significant losses on them and on real estate when the bubble burst, then whatever was happening, the fiduciary governance structure was not intact.

Why I No Longer Have a 401(k)

I have told this story at solari.com before – see “Financial Coup d’Etat and Your 401k”

At the same time that billions of dollars started to disappear from HUD, my company Hamilton Securities, which was serving as the lead financial advisor at the Department of Housing and Urban Development, was targeted by the US Department of Justice (DOJ) and the Inspector General at HUD.

When the government attacked, it came after every different aspect of my credit and finances – both personally and professionally. I had $500,000 in a 401(k). I had used these funds to finance Hamilton Securities, and then when the company was successful, it paid the 401(k) back. I had the vehicle in place and I could use it to finance the company again. Sure enough, what did the government do? The IRS put the 401(k) under audit, which meant that I couldn’t use it to finance the company.

What happened next? The DOJ demanded huge amounts of make-work for subpoena compliance that cost hundreds of thousands of dollars. It issued subpoenas that required about $200,000 of, essentially, make-work on backing up servers and repetitive subpoena compliance. I busted the 401(k), paid $250,000 in taxes, and spent the $200,000 on doing the contract compliance. That was the end for 401(k)s and me.

Many years later when I won the litigation and monies were paid to Hamilton Securities, my CPA said, “Great! Let’s refund $500,000 into the 401(k). I said, “Nope. I’m never going to have a 401(k) again.” I had learned my lesson. It’s not my money if I am in partnership with the US government. It is an untrustworthy partner that I cannot depend on to obey the law.

One thing that you know if you’ve ever worked out the compound interest rate on tax deferral is, where it’s legal, tax avoidance and tax deferral are profoundly attractive. At the same time, my feeling is, given what I do, if I put a dime into a 401(k) or an IRA, “it ain’t my money.”

There are many situations where I may recommend to clients that they keep their 401(k) or IRAs. It’s unique to the person. So I’m not saying that you shouldn’t have a 401(k), I’m only saying that I consider the US government – for someone in my situation doing what I do – to be an untrustworthy partner. What is interesting is, if you look at the headlines these days, including the most recent interview I posted on Solari from Bill Binney, the DOJ is now openly and blatantly lawless. They are trying to do to the President of the `United States what they tried to do to Bill Binney – unsuccessfully – and they tried to do to me – also unsuccessfully.

I will never put a dime into a 401(k) or IRA. Every year I read Dave Collum in his annual review denigrate people who buy bottled water when their 401(k) is not fully funded. That’s me. I travel with water from my well when I travel by car. However, airports now refuse to let me take my water through security, so I buy bottled water. Having been poisoned on multiple occasions during the litigation followed by years of detoxing, I understand how essential it is to stay hydrated – especially while traveling. The notion that I would shortchange my health to put money in a vehicle partnered with the US government is amusing. It will never happen. Sorry, Dave!

My “Community” Bank

At the time the litigation began, I had loaned (or given) $250,000 to friends and family. I know that Solari Report subscribers who are familiar with my work have heard this story before. This was $250,000 the government couldn’t seize. They could not get my bank to dirty trick me (Yes, Hamilton Securities had one local bank that worked with the government and their private “snitches” to cheat us) on that $250,000 because it was not in my bank account. It was in the bank accounts and personal assets and savings of many different members of my family and my friends.

I had an uncle who was financially secure. He decided to help me because I had a long tradition of helping other members of our family. I hadn’t loaned or given him any money. However, he had witnessed me be generous and help family and friends. He said, “Okay, she took care of us, so I will take care of her.” Those personal loans and gifts and the help from my uncle actually kept me alive. It was the one source of money that the government could never shut off and they tried. They made threatening phone calls to my uncle and showed up at his door in the middle of the night with a subpoena. I was lucky. My uncle was a strong, principled man. The smear and scare tactics did not work.

When I finished the litigation and became an investment advisor, one of the things that I noticed looking at clients’ portfolios and financial statements was that they were working hard to fill up their 401(k)s and IRAs. At the same time, they were not spending sufficient amounts of money on their preventative health care or healthy food – or they weren’t helping their kids buy homes, or reinvesting money in their skills and business. They were starving their family and their businesses of sound investment. This was all on the theory that they had to put more money into their 401(k) and IRAs. What they didn’t understand was that they had been trained to suck up all of the money they needed for their family, for their health, for their community, and, turn it over to large corporations to finance the national security state.

When I settled the litigation, I took the $500,000 that my CPA wanted to put into my 401(k) and repaid and gifted it to the people who helped me survive and succeed. I was convinced that the friendly folks at the DOJ were going to arrange for the IRS to go after me. I knew that if the money were in my “community bank,” there would be less to go after. The thing that kept me alive was personal loans and gifts and the people who helped me at great personal risk. I had loaned and gifted $250,000, and that was what came back albeit not necessarily from the same people; it wasn’t tit-for-tat.

It was like the Great Mandala; you put it out, and it comes back around. I put that $500,000 back out in the “community bank” and I am confident that it is coming back around.

Healthcare

I told the story of my health care saga in a commentary called “Musings on Health, Health Care and Health Insurance ”

I came to the realization during the litigation period that I could not depend on the traditional healthcare system. It was increasingly unproductive or unsafe for someone in my circumstance. I also concluded that if I continued to pay for healthcare insurance, I would not be able to afford healthcare. In fact, I didn’t need healthcare insurance; I needed healthcare. This started me on a journey of discovering highly economic and practical natural alternatives.

During this period I visited the original homestead of my family when they came to Tennessee four generations ago. It was a log cabin with a dirt floor and no windows – with no heat and no running water. Ten people had lived there for the first winter in Tennessee in the 1850’s. I realized that my ancestors had long lives for thousands of years without healthcare insurance, without pensions and without disability insurance- all of the things that, as a successful professional person, I thought I needed.

Somehow standing inside the log cabin broke the trance. From then on I focused my health care dollars on good nutrition and caring for my own health as much as possible. I became much more adept at navigating the traditional systems when I needed to access the wonders of modern medicine.

As described in the commentary, this approach turned out to be the right one for me.

My Pension Fund

I had a pension fund from my career on Wall Street. Occasionally as I was organizing my finances, I would call up the US subsidiary of the global bank that owned the bank that had bought the company I worked for that was now the administrator of my pension fund. I tried to get signed up on their online system. The bank would deny that I was in the pension fund. It insisted that it had no obligation to provide me with a pension fund.

I got frustrated, so I had my lawyer call. Again, they denied that I was in the plan. They refused to recognize my documentation.

At the same time, I had a partner who persuaded me that I should apply for social security early because, if you look at what I could do in terms of investment with my existing savings, he calculated I would be better off taking social security early. And he argued, the system was not trustworthy – if I waited they could change the rules on me. In the process I received a document from Social Security that authenticated and confirmed that the pension fund had sent a confirmation to the Department of Labor that I was in the pension fund and was owed a monthly benefit at a certain level. I now had an official government document that certified the pension fund itself had reported to the federal government my being a beneficiary.

So I called the bank again, and lo and behold, it still insisted that I wasn’t in the pension fund. So I sent them a copy of the document. About three weeks later I received a call from a person from the bank who was clearly too senior to be doing customer service – even for a situation like this. I suspect, but I cannot prove, that what had happened was that, for political reasons, someone made sure that my name was out of the database, and after investigation they discovered, “We need to put her back in.”

It could have been my old Dillon Read partners trying to make sure that I could not get my pension fund. However, it could simply be the pension fund trying to wiggle out of as many obligations as possible. Whatever the reason, I got the world’s most charming senior executive handling my account. I proceeded for the next month or two to get online and my pension fund began its regular payments in the course of the next year.

No matter how bad you know corruption and fraud are, it always shocks when it happens to you. It’s like being dropped from a seesaw to have it touch you in this manner. I believe that there was an intentional effort to cheat me out of my pension fund. You determine what you think happened and why.

Frankly, if it hadn’t been for the honest civil service in the US government, I would have been out of a significant flow of income for the rest of my life. It’s not the first time that US civil service has pulled my chestnuts out of the fire.

So between what happened with my 401(k) and my Wall Street pension fund, I don’t have much confidence in the pension system. I’m far from a random sample. We have a financial system in which the governance and the enforcement are sufficiently corrupt that it’s difficult to have confidence in the integrity of the system. This is why it is important that you investigate your unique situation and assess integrity at the individual fund and institution level.

My Home

One of the primary sources of retirement savings is capital gains on the family home, farm, land and real estate.

I had a very beautiful small mansion in Washington. In the process of the litigation, I experienced incredible jealousy and anger coming from the people attacking me about how beautiful my home was. Indeed, when I was Assistant Secretary of Housing, the Secretary of Housing informed me that he would never accept an invitation to attend an event at my previous home (a Washington brownstone), saying “your home is bigger than my home, I would find it castrating.”

I proceeded to sell my home and about every possession in it – all my antiques, most of my art collection, everything, including selling family antiques back to relatives – to finance the make work and deal with the smear campaigns, litigation and physical harassment. Needless to say, it was difficult to generate an income when the workload created by government required 70-100 hours a week of work for many years.

At various times I had my house and my possessions used as weapons against me. When I traveled after I moved to Tennessee, every time I returned home, there was one thing of sentimental value or financial value gone. It happened so consistently, I was sure it was no accident. My research showed that this was “standard operating procedure” in such circumstances. So I made a decision to dispose of almost all my possessions. I made a list of everything that had any sentimental or financial value, and I sold them or gave most of them to my relatives and friends. Indeed that was quite a Christmas if you knew me at that time – I had one relative who received a Renoir print for Christmas.

When I settled the litigation I said to myself, “No one is ever going to use my possessions as a weapon against me again. I will buy the smallest possible home. I’m going to buy something where I can have my own well – where I don’t have to depend on fluoridated water systems. I will buy a home in an area where costs and taxes are extremely modest. I will use the remnants of remaining furniture – I will not redecorate.”

I have three small properties in Hickory Valley, Tennessee. My combined property taxes on all three are approximately $500 a year. So let’s say that there are terrible state and local municipal funding problems and my property taxes are tripled, then I’m paying $1,500.

I know of people in states or high-cost areas with high property taxes. If they double their property taxes, the taxes can destroy the value of the real estate. It can’t destroy the value of my real estate – my value is too small. I didn’t try to buy a home in an area where I thought I could make decent capital gains. I wanted a home that –if it were firebombed, it was the bank and the insurance company’s problem, not mine. I could come up quickly in a new place.

I wanted to put my money in the things that had worked for me. I knew that if I invested in Netflix and Amazon I could make money, but I didn’t come here only to make money. I came here to make a difference. So I invested in launching and building the Solari Report and Solari Investment Advisory Services and in building a global network of people making a difference all around the world.

One of the reasons I chose to stay in Tennessee was because of the due diligence I did on the state budgets and the state pension fund system. They were conservatively managed. Every time I deal with state and local governments here in Tennessee, I get somebody who is competent, who is perfectly pleasant, but tough. These attitudes are certainly reflected if you look at their pension fund arrangements. Our state pension funds have one of the highest funding ratios in the country.

If you come to Tennessee, people live much more modestly than many other states. We have no income tax, but we do have a high sales tax. In my hometown of Hickory Valley, if you go to the city council meeting once a month, the first thing that the mayor and city council do is open the mail, go through the bills, and write the checks. There is no staff and no payroll other than our part-time policemen. This is one of the reasons my property taxes are so low. Our municipality is a very modest operation that never built up the overhead that has happened around the rest of the country. In fact, if everyone in Hickory Valley stopped paying their taxes, the town has enough municipal reserves to operate for several decades.

If you look at where we are concerning the economic outlook, I have enjoyed fewer capital gains since 2000 on my property than I would have if I were in Chicago or San Francisco. However, I have enormous protection from increases from unfunded state and local obligations, a failure of local municipal services and from inflation. If inflation increases, overhead could be hit significantly. If we get a significant fall in the value of the US dollar, it could be even more significant. A low cost overhead protects me relatively to being in a high cost area.

I did an exercise two years ago looking at all of this. If when I started Hamilton Securities, instead of doing Hamilton, I only invested my money in the stocks I thought would go up during this period, how much would I be worth?” I figured that I would probably be worth – at a minimum – $40 million. I showed my analysis to a very good friend. She looked at me and said, “Yes, but you would be dead.” She was right. If you look at what I would have had to live with and emotionally tolerate, I’m not someone who can watch people being genocided around me and do nothing. To sit around and do nothing would have literally killed me. And If I had stayed in the traditional healthcare system instead of getting to know a wonderful world of natural health and nutrition practitioners, that would certainly have killed me.

One thing I will say – if my net worth is not at the $5-10 million level that many advisors would insist is necessary for a secure retirement – I would say the primary reason is because the cost and time required to live successfully in the face of significant criminal elements has been and continues to be enormous. It was certainly not the result of a failure to save. When you donate approximately 30,000+ hours of make-work to litigating with the federal governments efforts to falsely frame you during your prime working years it qualifies as a “deep state drain.” This is why I am consistently shocked when Americans suggest I should donate more time to helping the US government.

So it’s an unorthodox pathway that I’ve taken. I have constantly moved away from untrustworthy systems towards trustworthy systems. Sometimes that has meant going without or going it alone. If you look at my experiences with the 401(k) system, with federal law enforcement, with the pension fund system, with one of the largest global banks in the world, or the community bank in Washington that I believe defrauded Hamilton Securities, what I have found is that many of these different systems are untrustworthy. The moral of the story is to do your best to stick with trustworthy people, institutions and governments. Seek integrity – there is still plenty available but you need to find and cultivate it.

If I were reviewing your situation, I would have to look at the specifics to understand how this applied to you. If you take someone who is in a corrupt 401(k) situation and in a corrupt pension fund system and in a state and local government that has sizeable unfunded liabilities, you’re talking about someone who can be harmed badly – even destroyed – by what is coming.

VIII. TOTAL ECONOMIC RETURNS – WHY ARE WE FINANCING GOVERNMENTS, COMPANIES, AND PRODUCTS AND SERVICES WITH NEGATIVE RETURNS?

When a private investor buys stock in a company that is making money by doing something harmful to the environment, people, or economy, the investor may say, “I am only one person. I have to go along with what makes money in the market. There is nothing else I can do.” Although I do not agree with this point of view, it is true that the typical impact of one person is small. However, for a large US pension fund, investing a portion of $25 trillion in US retirement savings, it is hard to make the same case. If a large pension fund is making money on corporate or government activities that shrink the overall economy or harm the health and well being of the general population, ultimately the harm done to the whole will shrink the total economic pie.

Our pension funds are large enough, in fact, that they can understand and take responsibility for the health of the whole.

If one looks at countries where sovereign wealth funds and pension funds have taken an interest in long-term strategic thinking about what can make the economic pie healthy and as large as possible, those governors appear to have more support and trust from the general population. Indeed, a number of large US public pension have also provided leadership on public policy and corporate governance issues.

One area in which this question of “total economic return” is pertinent is health care. One challenge for the US pension systems is underfunding of health care benefits. One reason for underfunding is that health care costs are exploding. The United States does in fact spend significantly more per person than other countries on health care, but that investment does not translate into a healthy population.

When one studies the health care corporate profits that generate high stock prices, one sees how the pension funds are making a nice profit on activities that are slowly but definitely bankrupting them with health care liabilities. They are also financing the US government as it passes laws, enforces regulations, or provides subsidies that ensure that the health of the general population will deteriorate.

Another area is the black budget. We know that the US government official outstanding debt is $20 trillion. We also know that there are $21 trillion in undocumentable adjustments in federal accounts between fiscal 1998-2015. Let’s say for purposes of this example that this $21 trillion works out to $10 trillion in cash that was transferred into the black budget, creating valuable assets and technology now owned by private companies and investors. A significant amount of that transfer would likely have been financed by the purchase of US Treasury securities. US pension and retirement accounts are significant purchasers of these securities. In that case, the US federal financial operations have been used to transfer trillions in real savings out of our pension funds and into private companies and investors. The assets our pension funds now own are IOUs from ourselves as taxpayers backing the US government. We have transferred real savings to private investors in exchange for an IOU from ourselves.

If you step back and look at the operation carefully – particularly in a world where interest rates are extremely low – the US government appears to have become a money-laundering operation that transfers our private savings into the black budget in exchange for an IOU, to which we taxpayers are liable.

It seems that the pension funds have a responsibility not to permit our savings to be systematically drained. No doubt some people would still argue that the pension funds are in part protected by owning stock in the companies that benefit from asset and technology transfers.

If we allow our family wealth to be centrally managed and controlled, it seems that we have an obligation to ensure that our pension management understands and makes sure that the total economic return of pension investments is sound. If you look at the shenanigans that the US pension funds have been financing all along, you would expect them to outperform the benchmark considerably. But they have under performed the benchmark, making our situation much more frightening.

IX. OTHER ISSUES

There are other issues to consider when addressing the condition of our pension funds.

Leadership and Management

The first – and most important- is the integrity of the governance structure. Increasingly we are seeing business and government leaders compromised by surveillance, covert operations and control files. We need to ensure that people who govern and manage our pension funds are qualified to do so and free to govern and manage without pressure or influence to cause them to act in ways contradictory to the laws or best interests of beneficiaries.

Fiscal and Monetary Policies

Another issue is the impact of monetary and fiscal policies. Falling interest rates have reduced pension fund fixed-income returns. At the same time quantitative easing has debased currencies, contributing to the bubbling of real estate and stock market returns. These policies have contributed to long-term misallocation of capital. It seems that the pension funds should have a greater say in monetary and fiscal policies rather than passively continuing to finance them.

Defined Benefit vs. Defined Contribution

One of the links that I put in the bibliography is an interesting letter from one of the teachers’ groups in reply the John & Laura Arnold Foundation encouragement of defined contribution plans, as opposed to defined benefit plans.

When you look at underfunding of pension benefits, your first conclusion might be to agree, “Oh, well, rather than promising a defined benefit and then struggling in the political or corporate process to make it happen, let’s switch to defined contribution. Then if the market or the dollar collapses, the beneficiary will assume the risk. We can’t have the state and local government or the corporations responsible for coming up with a set benefit. It’s just too risky and too difficult. So let’s shift responsibility to the beneficiary”.

There is a certain logic in having beneficiary risk rise and fall with the market. That structure would be more flexible and more attractive to some parties. You have the benefit of the beneficiary taking the risk, but central managers still get to continue to control the capital: the best of both worlds for the people who run the financial system.

But the problem remains: If you look at the bailouts and the money missing from government and at the largesse of quantitative easing– which all come together in ‘the financial coup d’état’ – you see that we are guaranteeing a no-risk, zero-cost capital world to insiders, and then turning and saying, “You know what? Not only are we going to force the general population to finance our mistakes by bailing us out, but we are not going to maintain our legal contractual obligations to those people.”

There was no legal and contractual obligation to provide the banks with $24+ trillion, and there is certainly no legal mechanism under the law to disappear $21 trillion, or whatever the real number is, from the Departments of Defense and Housing and Urban Development.

Our government is creating a defined benefit world for a group of people who don’t have any legal rights or contractual benefits, but are adding that “No, we won’t maintain the defined benefits for this other group of people whom we call outsiders’. We want them to bear all the risk. They bore the risk on the housing bubble, and they bore the risk on the bailouts, and now they are going to bear the risk on the pension funds.”

So, the rich get richly defined guaranteed benefits and everyone else gets defined contributions. The rich bear no risk – all of which is borne by the general population. The big banks have a 0-1% cost of capital at the Fed window, while the poor are paying 30% on their credit cards and subprime loans for used cars.

And you ask what causes growing inequality? The answer looks obvious.

Index Funds

If you compare the 60/40 benchmark that I described in the performance chart above, essentially one might look at that and say, “Well, maybe we should just index investments.”

That’s not a good idea outside of working markets. The index system from the beginning was designed to depend on market pricing, and on some active managers to do research and analysis that provides market discipline.

As a result of government and central banks actively managing markets, we’ve lost honest prices. Then as more investment is indexed, we take out the analysts who dig and question and make a difference to the pricing and the market function. Lose enough capacity, and investors start flying blind. We lose the market discipline that indexers depend on for their approach to work.

If pension funds are indexed and if you’re not complaining about important issues related to total economic returns (such as iPhones addicting children), and if you do not fund managers to do the kind of analysis to make sure that you really want to buy this stock, you’re taking out the last remnants of market discipline. It’s a sporting match without referees. The entire society can take all of its capital and drive right off a cliff because indexing can make you very stupid. The allocation of capital becomes even more political and can be manipulated.

That said, we cannot continue to significantly underperform the benchmark. So, how do you return integrity to the leadership and management process? That question gets us back to the deep state drain.

Private Equity and Venture Funds

As central banks have loosened monetary policy, the competition for returns has resulted in an explosion of hedge funds, private equity, and leveraged buyout firms that try to generate both higher returns and fees. This includes moving to the front end of the investment process. They are buying companies before they undertake an IPO. Or they load companies with debt while soaking out their cash in a form of liquidation.

Many of those firms are financed by pension funds. I often say, “Why are you financing them doing things that skim off the front end ahead of what you get?” I suspect they are using the pension funds for, what we used to call “dumb money.”

This misuse of pension funds raises the question whether government and pension funds are going to support insiders making above-market returns by lowering total economic returns for all other people.

Earning Assumptions

Calculations of funding ratios depend on assumptions about future earnings and returns – which means that funding ratios can swing wildly, depending on assumptions about what will happen in the future. Beware presentations too dire or too rosy,,based on a swing in assumptions. Understand that the future is made up of multiple possible scenarios, and we all have a vested interest in helping ensure as healthy an environment, population, and economy as possible.

X. THE BOTTOM LINE

Let’s bring this down to the bottom line.

Let’s do some estimates about the component parts of what I call the financial coup d’état.

The bailouts consisted of loans and gifts to banks that had no contractual rights to such largesse. The estimate from the TARP Inspector General was a total of $24 trillion.